Let Us Turn Your Dream Home Into A Reality

Houston Mortgage Broker: Simplifying Your Home Loan Experience

Unlock the door to homeownership in Houston with Ebenezer Mortgage Solutions. Our seasoned team ensures a stress-free journey, offering tailored solutions and expert guidance every step of the way. Get started today and make your homeownership dreams a reality!

Ready to Start Your Home Buying Journey? Contact Us Today!

Don't let uncertainty hold you back from achieving your dream of homeownership. Whether you're a first-time buyer or looking to refinance, EMS is here to help. With our expertise, personalized service, and commitment to excellence, we'll guide you through every step of the home-buying process, ensuring a smooth and rewarding experience.

Contact EMS today to schedule a consultation with one of our experienced mortgage professionals.

Hear from Our Happy Homeowners

Michael Smith

Ponce-Garcia Family

Find The Best Mortgage Broker in Houston

When it comes to finding the best mortgage broker in Houston, EMS stands out for a myriad of reasons:

Expertise and Experience

With years of experience in the mortgage brokerage service and a commitment to excellence upheld by the Nationwide Mortgage Licensing System and Registry (NMLS), our team possesses unparalleled expertise. We comprehensively understand the local market dynamics, trends, and regulations, ensuring you receive tailored guidance and solutions that align perfectly with your unique needs and goals.

Extensive Lender Network

A mortgage broker can save you time, money, and effort. With our extensive lender network, we tap into a wide array of mortgage products and competitive rates, allowing us to shop around for lenders and find the best possible financing options for you.

Fast Closing Times

We understand the urgency of closing on your dream home. Working with a broker like EMS means swift and efficient processing, ensuring you move into your new home as quickly as possible without compromising quality or accuracy.

Loan Officer/Mortgage Broker FAQ

Are you considering a mortgage broker for your home loan needs? Here are some common questions answered:

A mortgage broker is an intermediary between a borrower and the lender, helping borrowers find the right mortgage product from various lenders. On the other hand, a loan officer works directly for a specific mortgage lender, bank, or credit union and offers mortgage products provided solely by that institution.

Yes, absolutely. Mortgage brokers can assist with refinancing existing mortgages. A mortgage broker helps borrowers find competitive rates and suitable refinancing options tailored to their needs and financial situation.

Choosing a mortgage broker over a bank offers several advantages:

- Access to Multiple Lenders: A mortgage broker works with multiple lenders and mortgage products, giving borrowers more options to find the best mortgage terms and rates.

- Personalized Service: Brokers provide personalized guidance throughout the mortgage process, tailoring their recommendations to the borrower's specific needs, credit history, and other financial circumstances.

- Competitive Rates: Brokers can often negotiate better rates and terms on behalf of their clients, potentially saving them money over the life of the loan.

- Convenience: Brokers handle much of the paperwork and negotiations in a mortgage process, saving borrowers time and hassle. Additionally, you won't have to worry about broker fees as lenders often pay the broker a commission when the loan closes.

The timeline can vary depending on factors such as the complexity of the borrower's financial situation, the lender's processing times, and market conditions. However, working with a mortgage broker can often expedite the mortgage application process due to their expertise and network of lenders. On average, the process typically takes anywhere from a few weeks to a couple of months from application to closing.

Working with a local mortgage broker offers several advantages. Local brokers often understand the regional real estate market more deeply, including trends, property values, and lending practices specific to your area. They can provide personalized guidance tailored to your local market conditions and help you navigate any unique challenges that arise during the home-buying process. Additionally, local brokers may have established relationships with lenders in your area, which can lead to better loan options and terms. Lastly, working with a local broker allows for easier communication and face-to-face meetings, fostering a more personalized and collaborative experience throughout your home-buying journey.

Top Neighborhoods in Houston, TX

Houston, Texas, boasts a variety of vibrant neighborhoods. Here are some top picks:

Acres Home

Lucky St

Greater Inwood North

Long Creek Ln

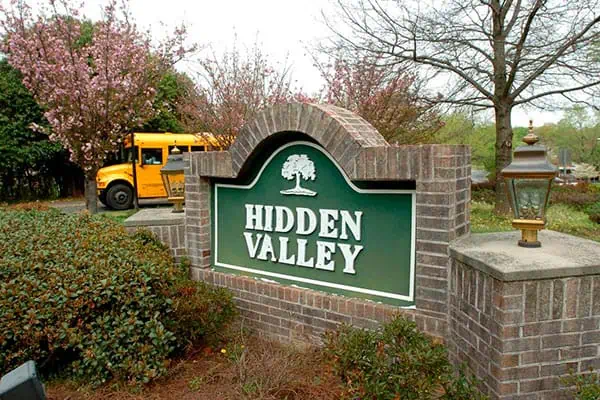

Hidden Valley

Things to Do In Houston

Houston, Texas, is a city brimming with excitement and cultural richness. Here are some must-visit attractions and activities:

Houston Museum of Natural Science

Houston Zoo

Space Center Houston

The Museum of Fine Arts, Houston