Your Most Trusted Partner in Home Purchase Loans & Refinance Loans

Open Hours: Mon. - Fri., 9:00 a.m. - 6:00 p.m.

The best way to improve your credit score is by using your credit cards prudently and paying bills on time. However, different people have different circumstances so this might not always be as easy as it sounds. If you are one of those people struggling with this issue, you'll be happy to know that there are methods available that might help make your credit score increase.

In this article, we're going to share 4 strategies to improve your credit score. But before we get to that, let's first discuss what a credit score is and why it is important.

You've probably already heard that a credit score is the most important number in your adult life. But why?

Firstly , a credit score is a number that represents your creditworthiness. Lenders use your credit scores to determine your ability to pay off debt obligations such as your mortgage, auto loan, and credit card debt.

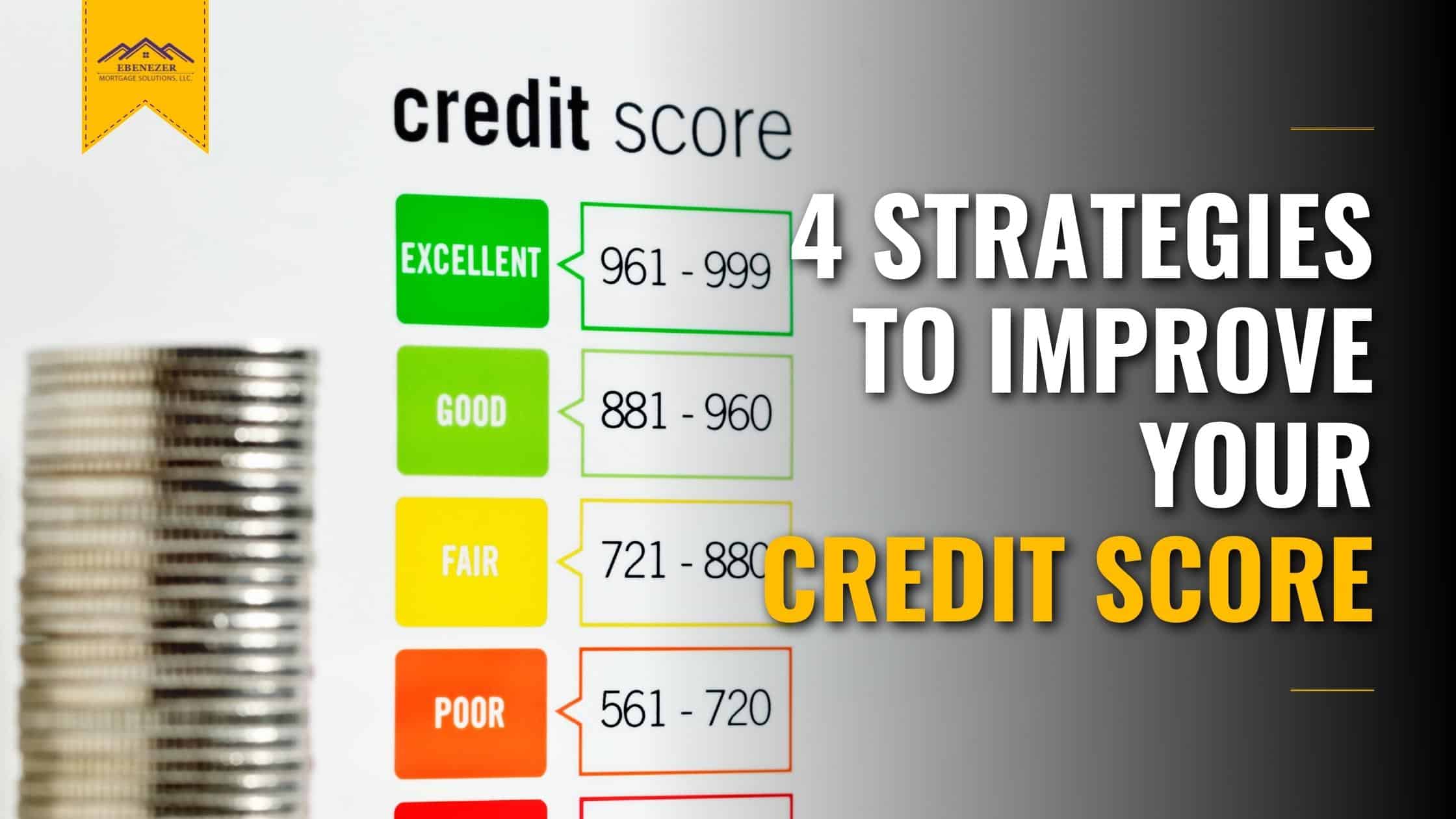

Your credit score will be based on your credit history which consists of your bank accounts, repayment history, and other financial factors. Although creditors might have their own parameters for credit scores, the following range is often used:

A higher credit score means that you're a low-risk borrower. This will get you better rates and terms from a private lender, bank, or credit union. With these conditions, you'll be able to save more money over time.

On the other hand, a lower credit score might show you as a high-risk borrower. Lenders will be less likely to accept you or they'll give you a higher rate. This can result in you paying more for the money you borrowed.

So if you want to get lower mortgage rates and better terms, then having a good credit score is the way to go. The methods needed to improve your credit score will depend on your unique credit situation. Nonetheless, the strategies we're going to share with you often work with almost anyone's credit.

Your credit score might also affect your credit limit. A good or excellent credit score might lead to a higher credit limit. However, it is advisable that you do not spend all this amount as it can affect your credit utilization ratio.

Your credit utilization ratio, also known as credit utilization rate, represents your total credit balance divided by your total credit limit. This ratio is one of the factors needed to calculate credit scores.

The standard rule of thumb is you only use up to 30% of your available credit. Having a lower credit utilization ratio means that you're using less of your credit limits. And this often interprets as you doing a great job managing your credit and not overspending.

Before your credit card issuer submits their report to credit bureaus, you'll want to make sure that you have a low credit utilization rate. The best way to attain this is by paying down your balance before the billing cycle ends. Another method is to pay several times in a month to ensure that your credit card balances stay low.

Another important strategy for increasing your credit score is to dispute credit report errors.

Federal law allows you to get a free credit report copy every 12 months from each of the three major credit bureaus. There are several ways to obtain credit reports but the most reliable one is through AnnualCreditReport.com.

Once you receive a copy of your credit report, check for any errors such as timely payments marked as late payments, incorrect balances on accounts, or inaccuracies in your identity information.

A paid-off account is a good thing. However, closing a credit card account, even if it has a $0 balance, is not always a good move. In fact, closing credit accounts might actually hurt your credit score.

Lenders often look for borrowers with a long credit history. Especially one that shows a solid track of consistent on-time payments.

Your account will turn into a collections account if you have consecutive missed payments. Your lender or creditor will assign your unpaid debts to a collection agency. It is then the collection agency's job to collect the money owed.

Being pursued by a debt collector can be stressful, but ignoring them might only lead to more problems such as facing a lawsuit. The best thing you can do is to face your debt head-on and start paying it off.

Having a collection account can have a negative effect on your credit report, which then leads to a bad credit score. So once you paid off your debt, persuade the collection agency to stop reporting your account. Collections can stay up to seven years on your credit report. But ignoring the problem will only lead to a longer wait time.

Raising your credit score improves your financial outlook. It gives you access to better loan deals which can result in lower monthly bill payments.

Want more tips on increasing your credit score? Or need help with your mortgage application? Ebenezer Mortgage Solutions is ready to assist you. Call us today at (813) 284-4027 so we can start getting you into your dream home.