Let Us Turn Your Dream Home Into A Reality

Expert Mortgage Broker Services in Town 'N' Country, FL

Simplify Your Home Loan Process with Ebenezer Mortgage Solutions – Your Trusted Mortgage Broker in Town 'N' Country, FL.

Why Choose Ebenezer Mortgage Solutions as Your Mortgage Broker?

Access to Competitive Mortgage Rates

At Ebenezer Mortgage Solutions, we work with a wide range of lenders to secure competitive mortgage rates. Our connections with financial institutions allow us to find the best loan options that match your financial goals, ensuring you get a great deal on your mortgage.

Fast Closing Times

We manage all the details, including the back-and-forth communication with lenders and gathering the necessary documentation, so your loan closes quickly. Mortgage brokers like Ebenezer work to ensure fast turnaround times for our customers, minimizing delays and keeping the loan process on track.

Tailored Loan Solutions

Whether you're seeking a conventional loan, FHA loan, VA loan, or USDA loan, our team helps tailor the best loan options to your specific needs. We guide you through the process from pre-approval to underwriting, ensuring the loan officer finds the right product for you.

Town 'N' Country, FL Mortgage Broker – Your Guide to Homeownership

Ebenezer Mortgage Solutions offers expert mortgage broker services in Town 'N' Country, FL, to help you find the best home loan for your needs. Our experienced team works with the top lenders to provide competitive mortgage rates for all types of loans, including Conventional, FHA, VA, and USDA. Whether you are a first-time home buyer or considering refinancing, we are here to guide you through the process, from pre-approval to closing.

Home Purchase Loans

Ebenezer Mortgage Solutions works with qualified lenders to provide you with the leading home loan packages, including Conventional, FHA, VA, and USDA loans. Whether buying your first home or upgrading, we’ll help you find a loan tailored to your financial situation, guiding you through the process from pre-approval to closing.

Mortgage Refinancing

Ebenezer Mortgage Solutions can help you refinance your existing mortgage to secure better interest rates or access cash from your home’s equity. Our refinancing options include switching from an adjustable-rate to a fixed-rate mortgage, lowering monthly payments, or eliminating private mortgage insurance (PMI) as your home equity increases.

The Pre-Approval Process

Getting pre-approved is a crucial step in securing a home. Ebenezer Mortgage Solutions offers fast pre-approval services to strengthen your offer and provide an edge in the competitive real estate market. Our team will review your credit history, income, and employment to provide you with a fast pre-approval, ensuring that your home loan process is smooth and efficient.

Client Testimonials

Michael Smith

Ponce-Garcia Family

Loan Types and Packages

Conventional Loans

Conventional loans are ideal for borrowers with strong credit and a solid financial background. These loans are not directly backed by the government but are supported by Fannie Mae and Freddie Mac, two government-sponsored entities that help make home loans more affordable by purchasing and guaranteeing mortgages in the secondary market.

- No PMI: Avoid private mortgage insurance with a 20% down payment.

- Higher Loan Limits: Borrow more compared to government-backed programs, making it suitable for higher-value property.

- Flexible Loan Terms: Choose between adjustable or fixed-rate mortgages with terms from 10 to 30 years, depending on your personal finance goals.

- Best for: Buyers with good credit, seeking real estate investment opportunities or second mortgage options.

Best for those with strong credit looking for flexibility and higher loan limits.

VA Loans

Designed for active-duty military members, veterans, and eligible surviving spouses, VA loans make homeownership affordable and accessible.

- 100% Financing: No down payment, allowing borrowers to finance the entire purchase price.

- No PMI Required: Save on private mortgage insurance, which lowers your monthly payments.

- Assumable Loans: Can be transferred to the buyer under certain conditions, making your home more attractive.

- Government Guaranteed: The Department of Veterans Affairs guarantees a portion of the loan, reducing risk for lenders.

- Best for: Veterans, military personnel, and surviving spouses looking for zero down payment options.

Ideal for veterans and military personnel seeking no down payment and low-cost home financing.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are designed to help more people become homeowners, especially those with lower credit scores or smaller down payments.

- Lower Credit Score Requirements: Minimum credit score of 500, making it more accessible.

- Low Down Payment: Only 3.5% down for credit scores of 580 or higher.

- Flexible Qualification: Easier to qualify for than conventional loans, even for those with higher debt-to-income ratios.

- Seller Assistance: Sellers or a real estate agent can assist with closing costs, reducing upfront expenses.

- Best for: First-time homebuyers or those with lower credit seeking affordable options.

Ideal for first-time homebuyers with lower credit scores or smaller down payments.

USDA Loans

USDA loans, backed by the U.S. Department of Agriculture, are designed to help people buy homes in eligible rural and suburban areas. These loans offer unique benefits for borrowers looking to purchase a home outside major metropolitan areas.

- 0% Down Payment: No down payment required for qualified borrowers.

- Low PMI: USDA loans offer lower private mortgage insurance costs, making them affordable.

- Easier Qualification: Easier to qualify for those with lower credit scores and moderate income limits set by the USDA.

- 100% Financing: USDA loans finance the entire property purchase without requiring a down payment.

- Best for: Borrowers looking to buy in rural or suburban areas with little to no down payment.

Perfect for those seeking affordable homeownership in rural areas with zero down payment options.

Resources for Homebuyers

Mortgage Calculator

Use our mortgage calculator to estimate your monthly payments by inputting the loan amount, interest rate, and down payment. It also factors in PMI, taxes, and insurance to give a clearer picture of your total monthly costs.

First-Time Home Buyer

As a first-time homebuyer, you may qualify for special programs like FHA loans or down payment assistance. We guide you through the best options, ensuring you take advantage of programs designed to make buying your first home easier.

Loan Process

We simplify the mortgage process with a clear, step-by-step approach. From pre-approval to closing, we handle the paperwork and guide you through each stage.

Contact Us for Expert Mortgage Advice in Town 'N' Country, FL

Looking for the best mortgage deal in Florida? Ebenezer Mortgage Solutions is here to guide you every step of the way, whether you're buying a new home, refinancing, or seeking pre-approval. Get personalized service from experienced mortgage professionals and let us handle all the paperwork to ensure a seamless mortgage process.

Loan Officer/Mortgage Brokers FAQ

A mortgage broker acts as an intermediary between the customer and multiple financial institutions, such as banks and credit unions, to find the best loan options. A loan officer typically works for a specific bank or credit union and offers loan products only from that institution.

Your credit history plays a significant role in determining your interest rate and whether you're approved for a mortgage. A strong credit score can help you secure a lower interest rate and better loan terms, while a poor credit history may limit your options or result in higher rates.

A down payment is the upfront payment made toward the purchase of a property. It’s typically a percentage of the total cost of the real estate. The required down payment can vary depending on the loan type and lender, but it generally ranges from 3% to 20% of the property value.

Underwriting is when the mortgage broker, loan officer, or financial institution reviews your credit score, employment, income, credit history, and other factors to assess your ability to repay the loan. The underwriter will ensure you meet all regulation and policy requirements before approving the loan.

Refinancing your mortgage can help you secure a lower interest rate, reduce your monthly payments, or change the terms of your loan. It’s also an opportunity to consolidate debt, access equity, or switch from an adjustable-rate mortgage to a fixed-rate loan.

A mortgage broker earns a fee for their services, usually paid by the lender or the borrower. The fee is typically a small percentage of the total loan amount and may be included in the closing costs. Brokers are required to disclose all fees to the customer to ensure transparency.

The Truth in Lending Act (TILA) is a federal law that requires lenders and brokers to provide clear, detailed information about the terms and costs of a loan. This includes disclosing the interest rate, annual percentage rate (APR), fees, and other important details, ensuring that consumers can make informed decisions when obtaining a loan.

Yes, a second mortgage allows you to borrow against the equity in your home. It's typically used for major expenses, like home improvements or paying off high-interest debt. The terms and availability of a second mortgage depend on your credit history, income, and the value of your property.

- Underwriting: The process where a loan officer or financial institution assesses the risk of lending you money by reviewing your credit history, income, and other factors to decide whether to approve the loan.

- Fannie Mae/Freddie Mac: Government-sponsored entities that help make home loans more accessible by buying and guaranteeing mortgages from lenders, which supports the secondary market. They play a key role in ensuring liquidity and affordability in the housing market.

- Secondary Market: The market where home loans and other financial assets are bought and sold between financial institutions rather than directly between borrowers and lenders. Fannie Mae and Freddie Mac operate in this market.

- Private Mortgage Insurance (PMI): A type of insurance required on conventional loans when the down payment is less than 20% of the property's value. It protects the lender if the borrower defaults on the loan.

- Debt-to-Income (DTI) Ratio: The percentage of your gross monthly income that goes towards paying debt, including your mortgage. It’s an important metric used in the underwriting process to assess your ability to handle additional debt.

- Truth in Lending Act (TILA): A federal law that ensures lenders provide clear and accurate information about the interest rate, fees, and other terms of a loan. It’s designed to protect consumers from predatory lending practices.

- Fiduciary: A person or institution legally obligated to act in the best financial interest of another party, such as a mortgage broker or loan officer acting in the best interest of a borrower.

- Freddie Mac/Fannie Mae Loan Limits**: These refer to the maximum loan amounts that Fannie Mae and Freddie Mac will purchase or guarantee. Understanding these limits is crucial for determining the type of loan you can qualify for.

- Mortgage Calculator: A tool that helps you estimate your monthly mortgage payments, including interest, principal, taxes, and insurance. It’s crucial for budgeting and understanding your financial obligations.

- Credit Union: A member-owned financial institution that provides services similar to a bank but often with lower interest rates and fees. It can be an alternative to traditional lenders for obtaining a mortgage.

Top Neighborhoods in Town 'N' Country, FL

The Cove

Bay Crest Park

Rocky Creek Estates

Twelve Oaks

Pat Acres Estates

Things to Do in Town 'N' Country, FL

Upper Tampa Bay Park

Big Cat Rescue

Westfield Citrus Park Mall

Waters Avenue Shopping and Dining

Countryway Golf Club

Rocky Creek Trails Nature Preserve

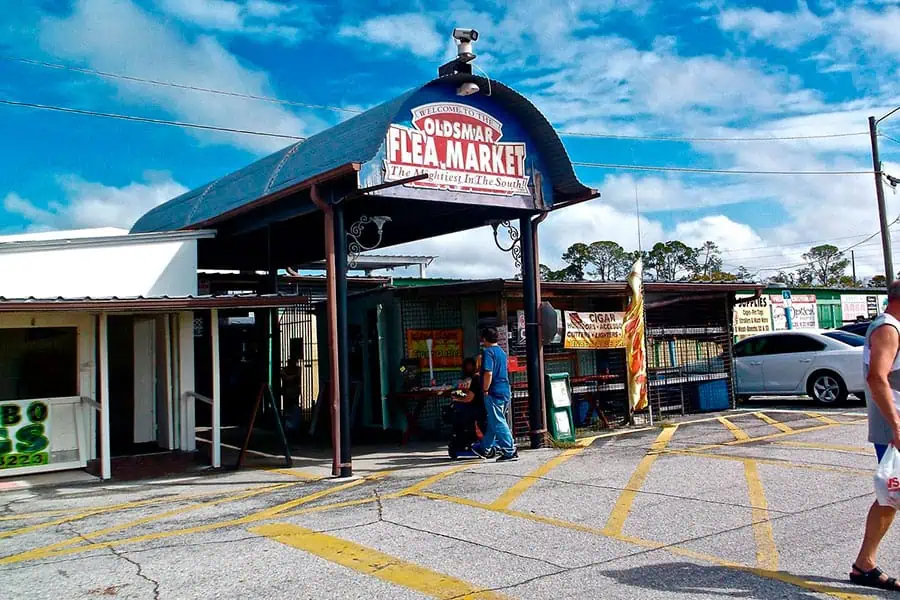

Oldsmar Flea Market